The Facts About "Top 5 Forex Trading Strategies That Actually Work" Uncovered

Understanding the Basics of Forex Trading: A Beginner's Overview

Forex investing, also recognized as international swap investing, is a decentralized international market where money are acquired and offered. Along with an typical day-to-day exchanging volume of over $6 trillion, it is the most extensive financial market in the world. Currency exchanging supplies people and institutions the opportunity to trade one currency for another with the target of producing a earnings.

If you are brand-new to foreign exchange investing, it can easily seem to be frustrating at to begin with. Having said that, with some essential know-how and understanding of how the market works, you may start your experience towards ending up being a prosperous foreign exchange trader. In this beginner's guide, we will cover some of the crucial principles and phrases that you need to have to recognize before diving right into foreign exchange trading.

1. Money pairs: In foreign exchange trading, currencies are always traded in sets. The initial money in the set is phoned the foundation money, while the 2nd money is contacted the quote currency. For example, in the EUR/USD pair, EUR is the bottom unit of currency and USD is the quote currency.

2. Pips: A pip stand up for "amount in aspect" and represents the littlest unit of price activity in a money set. The majority of money are quoted to four decimal area, so a pip is equal to 0.0001.

3. Leverage: Take advantage of permits traders to manage bigger settings with a smaller amount of funds. It provides traders the capacity to magnify their incomes but also boosts their risk exposure.

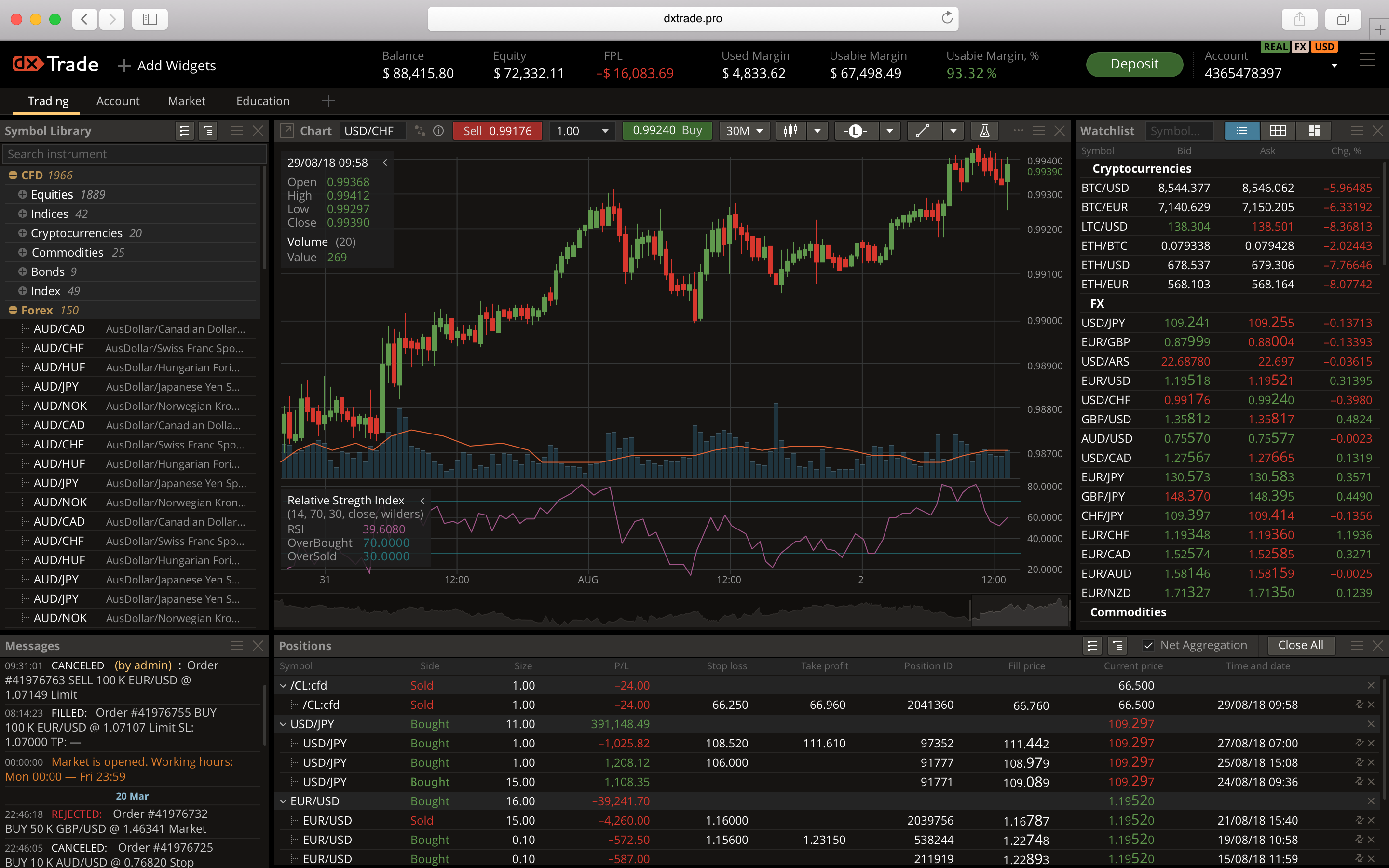

4. Bid/Ask price: The offer price embodies what shoppers are eager to pay out for a certain money pair at any type of provided instant, while the ask price represents what vendors are inquiring for that same money set.

5. Spread out: The escalate recommends to the difference between the quote and ask prices of a unit of currency pair and stands for transaction expense for investors.

6. Lengthy/Brief settings: Going long implies purchasing a specific currency set with hopes that its value will definitely enhance over time. Going short means offering a currency set along with hopes that its value will definitely decrease.

7. Technological evaluation: Technological review entails analyzing historical rate record and utilizing various resources and red flags to forecast future rate movements. It aids traders recognize potential entry and departure aspects for their field.

8. Basic analysis: Vital evaluation concentrates on economic, social, and political variables that can determine unit of currency costs. Traders who use basic review look at signs such as GDP development, passion prices, rising cost of living, and geopolitical activities to help make exchanging selections.

9. Demo accounts: A lot of foreign exchange brokers deliver demo accounts that make it possible for amateurs to practice investing without risking actual cash. Demonstration accounts provide a risk-free setting for you to know how the market works and test various approaches.

10. Danger management: Dealing with risk is vital in forex exchanging. It involves specifying stop-loss purchases to limit potential losses and implementing effective setting sizing techniques located on your danger endurance.

While this beginner's quick guide gives a general summary of forex trading, it is crucial to take note that coming to be a successful investor demands ongoing learning, method, and willpower. It is a good idea to begin with tiny business and steadily raise your direct exposure as you acquire even more experience and self-confidence in your capacities.

In final thought, forex trading can be an exciting possibility for people appearing to go into the world of economic markets. Through understanding the basics of currency investing – money sets, pips, take advantage of, bid/talk to cost, spread, long/short placements – along with technological and vital study principles, you can begin your trip in the direction of coming to be a prosperous trader. Remember to regularly handle your risks effectively and constantly educate yourself regarding the ever-changing dynamics of the currency market.